Correction of Errors in Accounting Questions

Correcting these errors can be explicit or implicit. This will help you avoid making costly errors calculating the payments due the DFVCP.

Accounting Errors And Corrections Double Entry Bookkeeping

Errors and discrepancies intentional or unintentional should be detected investigated and resolved in a timely fashion.

. There are many types of errors that can occur in a sentence and we will try to cover most of them here. There are 49 grammar questions on the SAT writing section. Set deadlines for data entry and reconciliation so that errors are found quickly and can easily be corrected.

Verify the recording of transactions in a timely manner. Bookkeeping is a necessary accounting function. The examination will consist of two sections.

Prior Period Adjustments are made in the financial statements The Financial Statements Financial statements are written reports prepared by a companys management to present the companys financial affairs over a given period quarter six monthly or yearly. So if you wanted to learn about gerunds and gerund phrases or when to use like vs. The post GMAT Sentence Correction Practice Questions is an excellent resource.

Restate prior interim periods to include that portion of the correction applicable to them. These changes added two examples no4 and 5 to IAS 8 that. Some accounting errors can be fixed by simply making or changing an entry.

You may also make your payment by check by printing out and mailing a paper copy of the electronically completed and filed Form 5500 or Form 5500-SF without schedules or attachments and a penalty check made to the Department of Labor for the applicable penalty. That said the first step in correcting accounting errors is to identify those. These will test consolidations and accounts.

For example a companys payment to an independent contractor for 500 was not entered in the books. For example the mistake in the previous example was made in 2017. An accounting change can be a change in an accounting principle an accounting estimate or the reporting entity.

Section B will contain 2 fifteen-mark multi-task questions. Include that portion of the correction related to the current interim period in that period. As questions on sentence correction are very frequent in several competitive exams we will cover such questions here in this section.

We will explore what that. Identification of sentence errors. Section A will contain 35 two-mark objective test questions.

Bookkeepers produce and manage financial records for small businesses nonprofit organizations and accounting firms. Errors from the previous year can affect your current books. As you can go to a post that focuses on that rule with examples.

It compiles links to other blog posts listed by the rule that they have to do with. The way around this is to add backdated correcting entries. APPENDIX D SUMMARY OF THE FASBS IASC US GAAP.

Transactions with Affiliates in a MasterFeeder Structure Financial Statement Presentation of Fee Waivers Correction of Errors and other topics. Record any portion of the correct related to prior fiscal years in the first interim period of the current fiscal year. Questions are of 3 types.

To make the correction add the 1000 debit and credit dated December 31 2017. Questions will assess all parts of the syllabus and will test knowledge and some comprehension or application of this knowledge. If any department IDs have errors make corrections on the Labor Distribution page and re-validate until all errors are corrected.

In this lesson we will discuss the correction of errors in language instruction. These statements which include the Balance Sheet Income Statement Cash Flows and. GAAP copyrighted by the Financial Accounting Standards Board Norwalk Connecticut USA 1999Please note.

Guidance for each of these types of changes is presented in separate headings. Though licensure is not required to work as a bookkeeper some professionals pursue certification to demonstrate their skills to employers and stand out in the job search. A sentence is a group of words that have a syntax and convey a certain meaning.

A Report on the Similarities and Differences between IASC Standards and US. Fortunately changes to IAS 8 effective from 2023 clarified that the effects on an accounting estimate of a change in an input or a change in a measurement technique are changes in accounting estimates unless they result from the correction of prior period errors IAS 834A. Frequently Asked Questions on IM Guidance Update 2016-06 Mutual Fund Fee Structures Last Updated.

ACCOUNTING AND DISCLOSURE INFORMATION ADI. This document is an excerpt from the FASBs The IASC-US. Yerleestatemnus if there are.

Review source documents to assure they are processed and. To access labor distribution rows for prior period adjustments. Sentence correction improving sentences Editing in context improving paragraphs.

Grammar accounts for over two thirds of the marks on this section. First why not check out some sample questions. Agency Payroll and Accounting staff should contact Yer Lee at 651-201-8074 or.

Trial Balance And Rectification Of Errors Mcqs Trial Balance Financial Accounting Trials

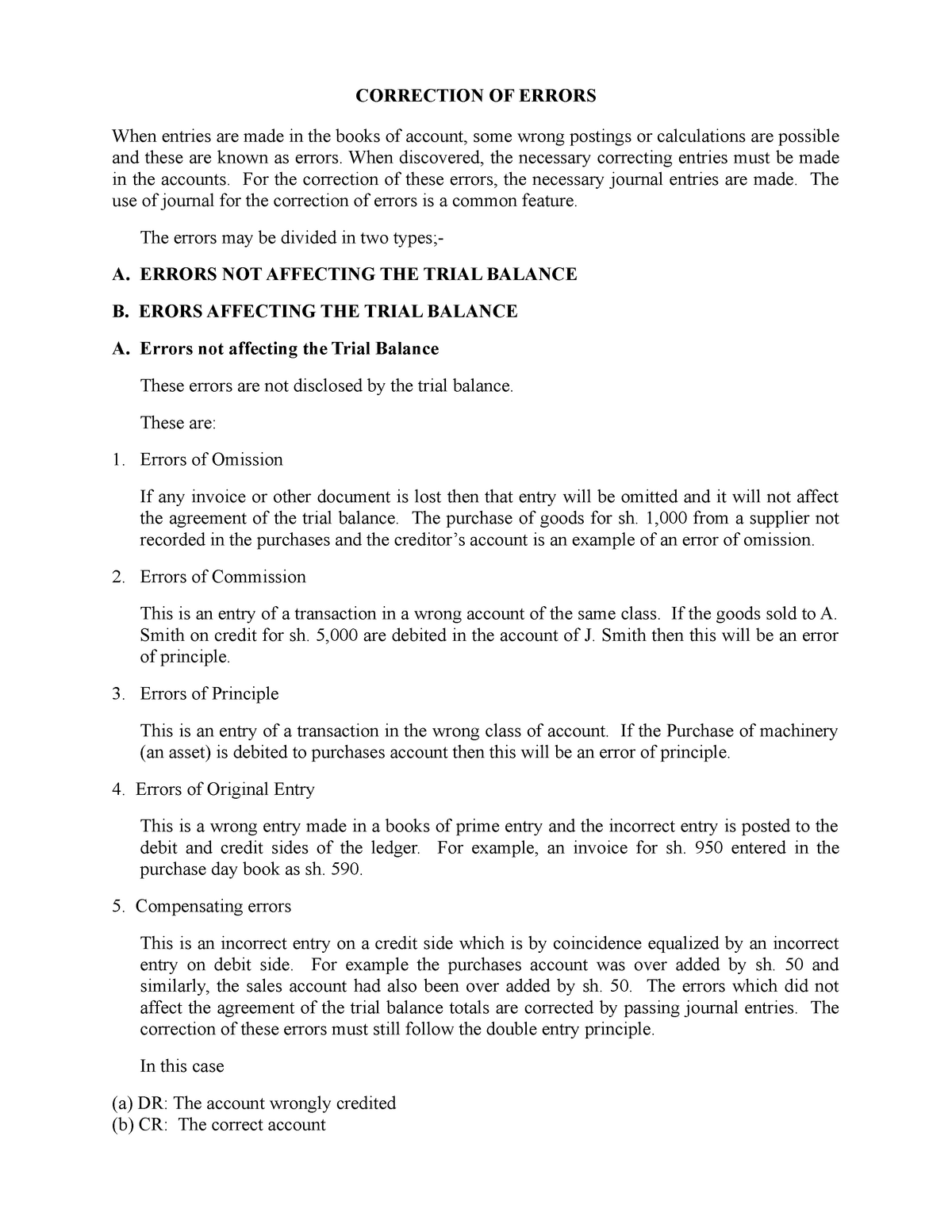

Correction Of Errors Lecture Notes 6 Correction Of Errors When Entries Are Made In The Books Of Studocu

Correction Of Errors And Suspense Account Ppt Video Online Download

Correction Of Errors 6 Errors Not Revealed By A Trial Balance Part 1 Of 4 Youtube

Comments

Post a Comment